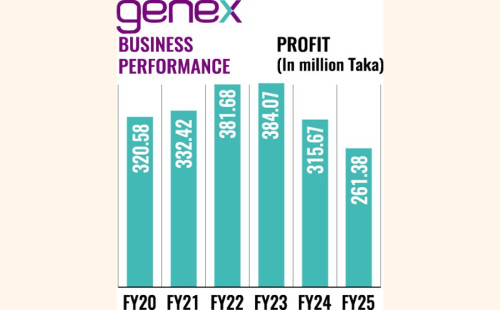

Genex Infosys FY25 profit falls 17pc amid costly diversification

Listed business process management (BPM) and IT services company

Genex Infosys reported a 17.18 per cent year-on-year decline in profit to Tk

261.38 million in FY25.

In a filing on Thursday, the company reported earnings per share

(EPS) of Tk 2.17 in FY25, down from Tk 2.62 in FY24.

The result surprised investors, as the company had posted a

profit of Tk 252.95 million for the first nine months of FY25, indicating 3.33

per cent year-on-year profit growth in the entire final quarter.

Genex Infosys has been showing a weakening performance since

FY23. Its net profit declined by 21.7 per cent in FY24 from FY23, and profit

fell by a further 17.18 per cent in FY25 to Tk 261.38 million.

According to experts, Genex Infosys continues to grow, but its

profit is slipping because expansion has become more expensive and risky.

The company initially succeeded by building a strong position in

IT outsourcing and call-centre services, which provided stable revenue and

profits.

However, as it moved to diversify and expand aggressively-into

infrastructure projects, telecom-related ventures, and other areas-upfront

costs, debt, and execution risks accumulated. These factors are now offsetting

the benefits of revenue growth, resulting in lower net profit despite higher

sales.

Following the decline in earnings, the company declared its

lowest dividend since listing-only 1 per cent cash for general shareholders.

However, it generated stronger cash flows in FY25, with

operating cash flow rising to Tk 6.87 per share from Tk 1.85 in the previous

year.

Shares of Genex Infosys traded at Tk 24.50 on Thursday on the

Dhaka Stock Exchange (DSE).

The company's price-to-earnings ratio stood at 11.29 based on

audited profit, while its dividend yield was only 0.63 per cent based on the

FY24 dividend.