Rising food prices push inflation to 8.29% in Nov

Inflation in

Bangladesh rose to 8.29 percent in November, driven largely by higher food

prices, highlighting persistent pressures on households, especially those with

low or fixed incomes.

The figure, released yesterday by the Bangladesh Bureau of Statistics (BBS), is

slightly higher than October's 8.17 percent but remains well below last year's

11.38 percent for the same month.

Data from the

BBS show that the consumer price index (CPI), which tracks changes in a basket

of goods and services, climbed in both rural and urban areas.

According to the Trading

Corporation of Bangladesh (TCB), essential food items such as rice, flour,

edible oils, lentils and onions, have witnessed an increase in November.

Besides, late autumn rain disrupted supplies and pushed up winter vegetable

prices.

Bangladesh has been grappling with persistent inflation for nearly three years.

Consumer prices stayed over 9 percent until May 2025 and have remained over 8

percent since then, sparking renewed debate about the effectiveness of recent

economic policies.

"Despite minor

fluctuations, there has been no meaningful change in the underlying

trend," said Selim Raihan, a professor of economics at the University of

Dhaka.

He noted that while the

Bangladesh Bank has tried to curb aggregate demand by raising interest rates,

such monetary adjustments alone have been insufficient to achieve lasting price

stability.

"This is because gaps in policy coordination, structural weaknesses in

markets, and external shocks have collectively kept inflation elevated,"

he added.

Raihan said the recent surge

in prices of essential food items such as onions and vegetables has been a key

driver of inflation.

"This clearly reveals

how fragile the agricultural supply system remains and how limited competition

in markets directly pushes consumer prices upward," he added.

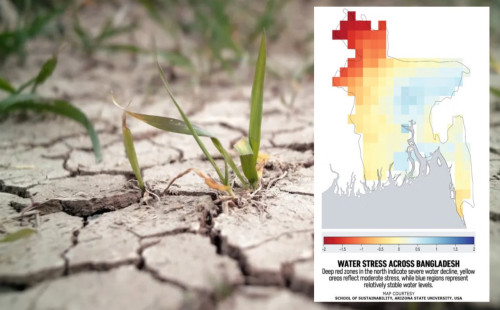

Volatility in global markets

and dependence on imports have further compounded the situation, Raihan, also

executive director of the South Asian Network on Economic Modeling (Sanem),

pointed out.

"In other words, current

inflation is largely driven by supply-side pressures, where conventional

monetary tools like raising interest rates have limited effects," he said.

Raihan added that addressing

inflation requires not only monetary measures but deeper institutional reforms.

These include disciplining anti-competitive market practices, improving

supply-chain efficiency, ensuring transparency in trade and imports, and

investing in agricultural production.

The economist said a lack of

coordination among fiscal policy, monetary policy, and market oversight as a

key obstacle to controlling prices. "Inflation today is not merely a

macroeconomic indicator; it reflects institutional weaknesses and policy

inconsistencies."

The solution, he said,

lies in building a coherent, credible, and long-term policy environment.

Economist Mustafa K Mujeri also made similar observations, saying that

Bangladesh's prolonged high-inflation environment is unlikely to ease without

stronger policy coordination beyond monetary tightening,

He said that the country has

been living in a "high-inflation regime for more than three years,"

while the only major tool used so far has been monetary policy.

"The policy rate has

been raised gradually and kept at around 10 percent for more than a year,"

he said, adding that the key policy gap is the absence of supportive measures

to complement monetary tightening.

Striking a similar tone to

Raihan, he said, "In Bangladesh, monetary policy alone cannot control

inflation."

Mujeri, executive director of

the Institute for Inclusive Finance and Development (InM), highlighted that

supply-side factors are a major driver of inflation in Bangladesh, limiting the

effectiveness of interest-rate adjustments.

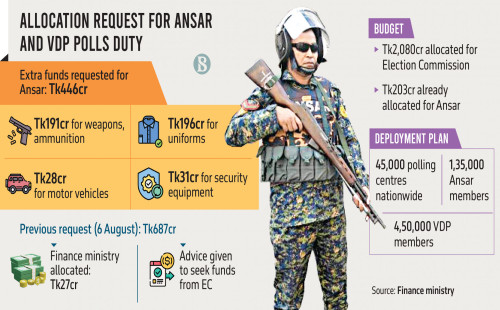

Election spending and

non-productive expenditures in the coming months could push inflation even

higher, he warned.

He said, "If the

election is held in February, money circulation - both formal and informal -

will rise.

"Candidates will spend

heavily, and government expenditure on election-related activities will also

increase. These are not production-oriented expenditures."

He added that

investment-driven production growth is unlikely during this period, while

Ramadan, traditionally associated with price hikes, is likely to further

intensify pressures in March.

Mujeri said whichever

government assumes office after the polls will need time to take effective

policy measures, delaying any immediate stabilisation.